Learning Options Trading

Learning Options Trading is a great way to add a new tools to your trading tool box. If you understand options and how they work you can open up a whole new world of trading. You can add options to your trading in many different ways.

Learning Options Trading is a great way to add a new tools to your trading tool box. If you understand options and how they work you can open up a whole new world of trading. You can add options to your trading in many different ways.

You can use options to hedge against a stock position you are currently holding. You can use options to control stock at a much discounted price. You can use options to get paid while waiting for a pull back on a stock you want to buy at a lower price. And the list goes on and on.

With all things there is a right way and a wrong way of learning something.

Learning Options Trading the WRONG way

Open an option account at the first option broker house you see online – deposit your money – buy a call option. Doing this is the fastest way to lose money. Ofcourse you could get lucky and make some money but over time you are going to lose if you dont know what you are doing. You could buy a call option on an underlying stock that moves up 10 points and yet the option you buy doesn’t gain anything or possibly could be losing money. And this all depends on the various factors such as – Time decay, buying an option Out of the Money – what the Delta on the stock is etc. Before doing any trading you must learn at least the basics.

Learning Options Trading the RIGHT Way

The right way is to open a simulated account (I highly recommend Thinkorswim.com). Go through the free training provided on the site – play around with order entries to get a feel for the platform. Come up with a trading plan on how you want to buy options. Test out the plan in the simulated environment. With Thinkorswim they have an option called Back In Time where you can literally go back in time and find an option price and see if your plan would have worked or not while you step forward day by day

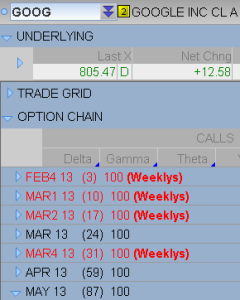

The best way in my opinion on how to play options is by using the underlying stock charts. For example if you thought a stock was going to move up for one reason or another – your broker gave you some info – the chart pattern looks good – good earnings just came out etc – you would open the option chain – find a option In the Money with a Delta of around 70 and with some time before expiration that allows you to hold it for awhile and purchase that call. But before purchasing the call know where your stop will be and where your target will be based on the stock chart. So if the stock goes below a resistance are then you sell your call.

This way your call will still be worth some money and you dont wait for it to expire worthless.

So in conclusion – learning options trading is a very smart thing to do – but make sure you go through the process of actually learning before jumping in – losing money – then giving up. And again I highly recommend ThinkorSwim.com they have a very powerful options platform and also offer a simulated environment and very good free training. If you are are looking for more specific option training – take a look at this info

**If you are beyond the learning phase and looking for a specific strategy take a look at this higher probability option trade discussed with details**