Option Straddles Explained

Before getting into Option Straddles Explained – you should at least know the very basics of options

- We want to buy a call option if we think the market/stock is going to move up

- We want to buy a put option if we think the market/stock is going to move down

Using options you can control a lot of stock for a lot less money. For example Google which at the time of this writing is trading at $xxx per share – if you wanted to buy or control 100 shares of GOOG it would cost you $500 . But in turn you can control the same amount of shares with an option for a fraction of the price. $5000 for 100 shares of Goog or $1500 to control 100 shares of Goog with an option

Option Straddles Explained

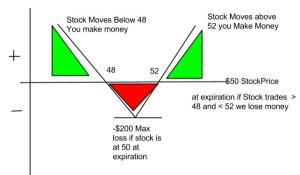

With Option Straddles you are buying both a Call (stock to go up) and Put (stock to go down) – the Call hedges or protects the Put and the Put hedges or protects the Call. So for example if you bought a call option and a put option for the same strike price and the price of the stock at expiration was the same – you would lose your investment that you paid for the call and the put. If the stock happened to move up a few dollars you would make money on the call and lose money on the put.

With Straddles you have a defined risk and an infinite potential on the trade.

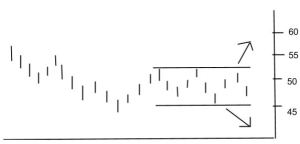

The main reason to use a straddle is if you want to take part in an upcoming event. One way to take part in upcoming stock news / events such as earning is by buying a Straddle. And if you buy the Straddle in the middle of its current trading range – you can make a good profit the day following the earnings whether the earnings are good or bad.

You would take the consolidation range and find the mid point and then

- Buy to Open 1 ABC $50 Call Option and

- Buy to Open 1 ABC $50 Put Option

You will have a debit of aprox $2 or 2 x 100 which equals a risk of $200 dollars

And like I mentioned above a great time to use this strategy is before earnings. Earnings anouncements bring a lot of attention and volatility to the stock. Every stock announces earnings 4 times a year. You can find earnings calendars online to see which stock is announcing earnings and when.

Examples of Stradle positions on stocks

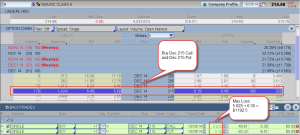

Generally want to buy the option that is 2 months out – so if its currently December you would want to look at the put and call prices in February.

Visa Example – Oct 29th

Day before earnings 5 day range – take high and low of range – find the aprox mid point which is about 215.

Open your option brokerage account – and look for Dec (monthly option chain) Buy the Dec 215 call and the Dec 215 Put – (I use ThinkorSwim)

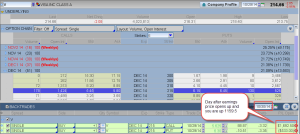

Earnings are announced after close on 10/29

The next morning you would log into your account and find something like this

Nice return from the day before. At this poin you can decide if you want to lock in your profit or let it run a bit with a protective stop – In this example it gets as high as +2500.

Not all stocks are going to move like that after earnings some will take more days to get there where others may not move as much as you expected.

Open up a Thinkorswim chart or any other chart that highlights earnings and scroll back and take a look at what the price does after earnings. You will want to find stocks with lots of volume and stocks that have a past experience of gaping after earnings announcements.

***Trading involves and is not suitable for everyone. Past performance is never indicative of future results. Trade at your own Risk. This Article is in no way a recommendation of any kind – please do your own research before making any trading decisions**