The velocity of money is the frequency in which a unit of money is spent on new goods and services and then at which that same money is again spent on other goods and services and how it continues to move from one person to another.

The velocity of money is the frequency in which a unit of money is spent on new goods and services and then at which that same money is again spent on other goods and services and how it continues to move from one person to another.

For example – I go to the grocery store and spend $20 on some food – the cashier takes that money and maybe later gives that same $20 as change to another customer – that customer then takes the $20 and spends it on Coffee – the coffee shop now has that money and can pass it on in another transaction.

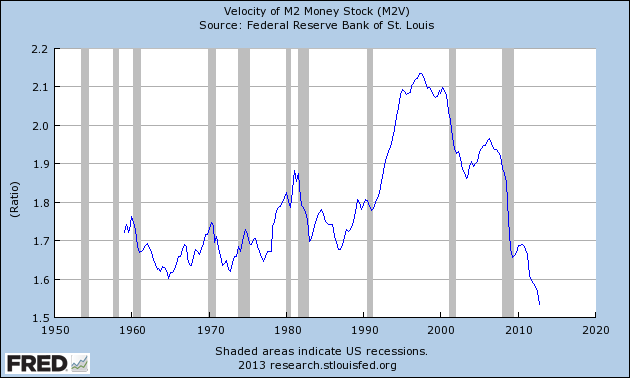

This indicator is one of the best indicators of economic activity out there – its better than GDP, Economic reports, the Stock Market, US Bonds etc.

In a strong economy the velocity of money is high and that same money gets transferred over and over – in a bad/weak economy the velocity of money slows way down. So in a down economy when people, companies and institutions have cash on hand they are less likely to take that money and spend it.

Velocity of Money is calculated by taking the GDP and dividing it by the money supply

(= GDP / Money Supply) .

The more money there is out there sitting idle in other peoples pockets – the slower the velocity becomes. Which brings me to the next point – As the Fed continues to print money the weaker and weaker the velocity of money is getting … the weaker and weaker the economy is getting.

According to the below charts from the Federal Reserve Bank of St Louis – we are at an all time low. Which isn’t that surprising based on the trillions of dollars the Fed is pumping into the economy.