Looking for a higher probability trade? Check out the details below …

This is a Iron Condor trade or two sell verticals.

The Instrument to do this on are the SPX, NDX or the RET. These are European style indexes which means you can not be assigned the stock if the option goes in the money. Unlike American style options in which the stock can be assigned at any time the option goes in the money.

With this play the direction risk is minimal because you are using a delta of 10 and a strike price so far out – but you do get Theta Decay.

Basics of the trade

Find the option that is approximately 60 Days from expiration with a Delta of 10 and Sell the Put Vertical and Sell the Call Vertical. Then after 30 days in the trade you close the position taking advantage of the decay in the option price and keeping the remaining credit.

On the Put side Sell Delta -10 Iron Condor Delta 10 options on both sides

Essentially this is a 2 standard deviation move which is very far away from the strike

So here is what you will do –

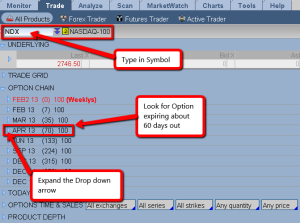

- Open up your thinkorswim platform (I highly recommend this platform for option trading)

- Click the Trade Tab at the top

- Enter the symbol (spx, ndx, ret)

- Look for the expiration date of about 60 days out – doesn’t have to be exact but close.

- By the Strikes section – Click the Drop Down arrow and select ALL

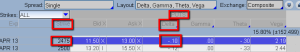

- In the Layout section Select Delta,Gamma,Theta, Vega

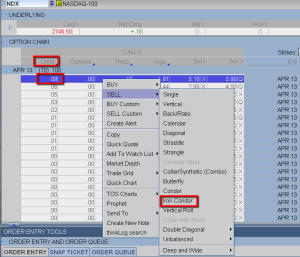

- You have two options here – you can sell each side (both the put and the call) or you can do an Iron Condor – It May be easier to do the iron condor – but you have to find and write down the information for the put side first so you can change the Iron Condor order

- Now look in the CALLS Column on the Left Side and look down the Delta Column for a Delta .10 or something close (my example is .09)

- Right click the Delta .10 call and select Sell – Iron Condor

- Now you will want to change the Strike price on the Sell Put from what ever is there to what you wrote down previously (2475)

- and you will want to change the BUY PUT to one strike price below (in this case 2 strikes below since the 1 below wasn’t trading)

- This will give you a credit of approximately $372 per contract

- And the idea is to hold this for 30 Days at which that point you should be no where near the Sold Call strike or the Sold Put Strike and the price of the Iron Condor should have reduce by around 50%. and you would close your position at that point taking off your risk

- You could hold longer if you wanted and try to hold it until its worthless but you leave the risk on the table

**If you are new to options be sure to get a knowledgeable foundation before attempting any option trading

Note: This article is not a recommendation of any kind for this type of trade – it is only a strategy I have learned and wanted to pass along. As with anything in the financial markets – there are risks involved – please consult your financial adviser before making any trades.